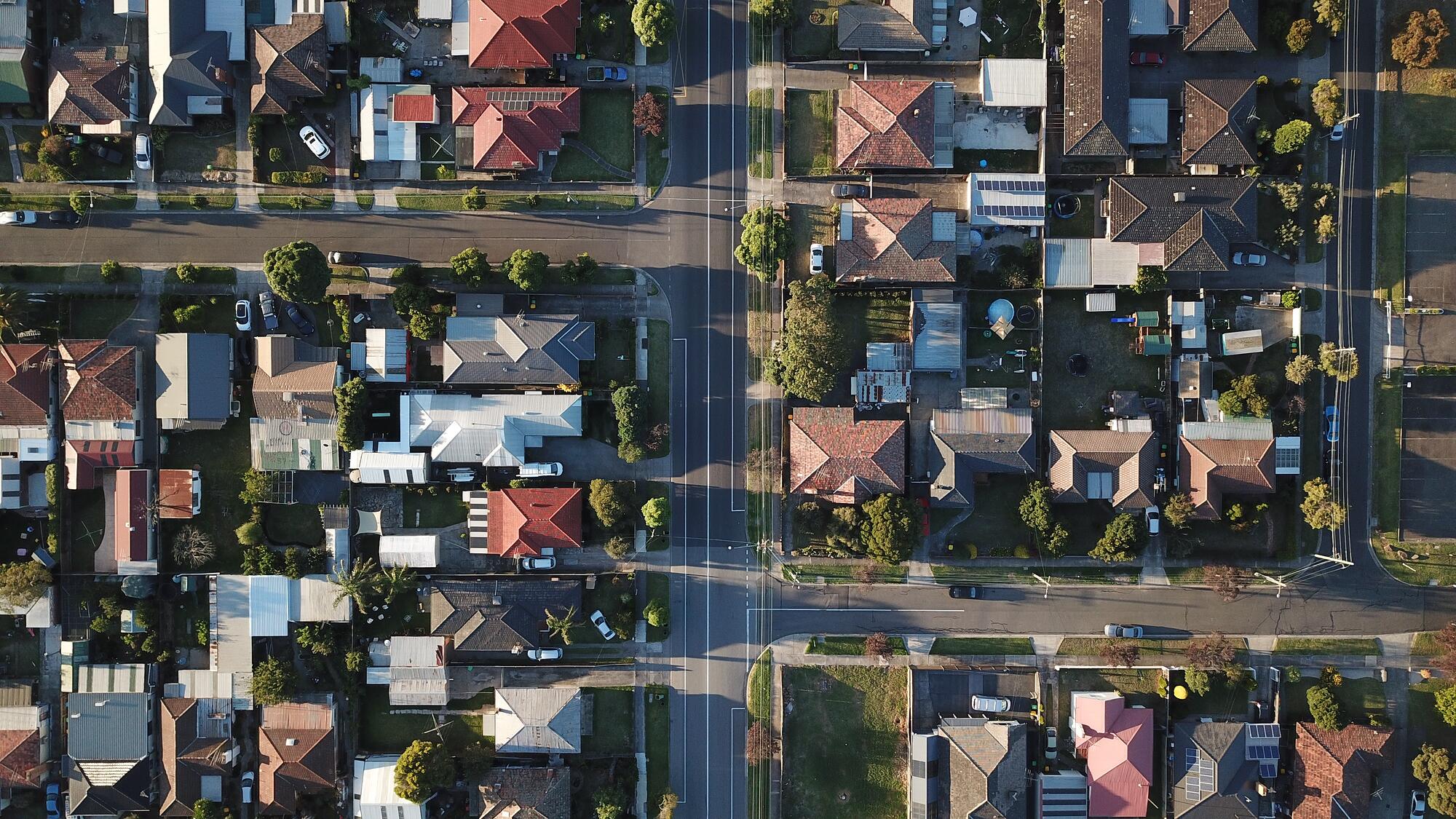

Investing in property is a solid asset, which has the potential to increase your wealth over time. The reason it is very important to invest in the right property is that one small mistake can cost you a lot.

Further, there are property related hiccups, setbacks and more that can bring on stress and worry and affect your outcome of a successful property investment. If you are in the property market to shop for your next investment, finding the right location is one thing you should never forget.

Here are some tips to help you pick the right location for your next investment:

1. Budget

For most property investors, your budget will help to decide the areas that you can afford to invest. The higher the budget, the more prime the location would be. Therefore, the best way to determine your budget is by asking a mortgage broker or lender. So, before you begin hunting for a new property, make sure you know your limit on investment.

2. Identify growth areas

The capital growth is one of the most important factors to consider when investing. So, look out for the areas that are growing and are expanding in the population. Check for infrastructure advancements, economic growth and more before investing.

3. Increase your options

With the area and budget, you are in a position where you can easily shortlist different areas where you might want to invest that are within your price range. You can seek help from the agents or check out property management services to buy. Ask, what you can buy in your selected area and within that price range to check out the options.

4. Check the returns

It is very important to buy property in the areas where cash flow is tight, and your investment won’t go into the red. Expensive areas are difficult to buy and are also expensive to hold. So, check them out too! Keep an eye on the rental yield trends before investing in the property.

5. Check out the tight rental market

When it comes to having vacancy rates, keep an eye on the tight rental market. Watch vacancy rate data on your selected property as investing in the low vacancy rates will cut down your chance of having an empty property between tenants.

6. Look at low-maintenance properties

Always look for the property that you can rent out with ease. For instance, properties with pools and large gardens need a lot of care and time. However, a simple property with a smaller block, the grassed backyard is easy to maintain. Also, such properties are easy to rent and are renters favourite.

7. Transportation and accessibility

No matter where you live, in the inner city or outer areas, you need access to easy transportation. The more transportation available in your areas, the more valuable your property will be.

Investing in real estate is quite local; one person’s investment location might be different from the best investment location for another person. However, in general, it should be desirable to your end customer and should also be profitable for the investor.

Want to know more? Get in touch below for a free demo or sign up to our monthly newsletter!